Contactless EMV transit payments: more than a pandemic response

by Andreea

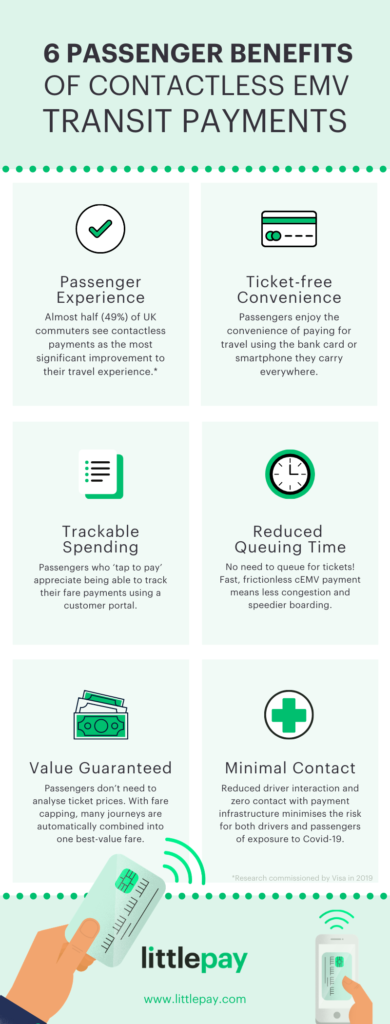

For transit agencies and passengers, there are diverse benefits of using contactless payment technology.

The pandemic has caused transit agencies globally to accelerate plans to provide contactless EMV (cEMV) payments. Limiting contact with cash and PIN-pads and reducing driver interaction, ‘tap to pay’ solutions protect passengers and staff from possible exposure to Covid-19. However, although the health crisis has quickened its pace, the shift towards contactless has been underway for years, pioneered by Transport for London (TfL).

By 2019, four years after TfL rolled out cEMV payments, 54% of pay-as-you-go journeys were paid for using this method. Passenger approval was driven by simplicity, ease of use and the seamlessness of travel. Instead of researching ticket prices, grappling with change and queuing for tickets, the network’s riders enjoyed the transformative experience of tapping on and off vehicles with the bank card or smartphone they carry everywhere.

In a Visa survey carried out last year of UK adults living in Birmingham, Glasgow, Leeds, Liverpool, London and Manchester, respondents that used contactless payments said it took the stress out of travel through increased convenience, ability to track spending (24%), reduced queuing time (45%) and alleviating the need for carrying cash (59%).

We’re committed to bringing the TfL payment experience to transit agencies of all sizes, everywhere. Our API-based, cloud native payment gateway connects with any certified card reader and a growing range of acquiring banks. With our payment processing piece at the heart of a loosely-coupled solution, we’ve created a system that’s cost-effective and speedy to deploy.

Littlepay now processes contactless EMV payments for more than 200 operators in the UK and Ireland. Many more in Europe and further afield have turned to us to help them deliver contactless quickly as part of their pandemic response.

Our team has worked with incredible efficiency to onboard sixty new transit operators since April and we’re pleased to play a part in reassuring their passengers it’s safe to travel. We’re also confident that, as operators and passengers start to use cEMV payments, they will discover the many benefits our system offers beyond hygiene.

Benefits of contactless EMV payments – for transit operators:

1. Flexible fare structures

Via the Littlepay Control merchant portal, transit agencies can configure fare aggregation and capping rules (with daily, weekly or multi-day rolling fare caps). Using this functionality, they can reduce card scheme (Visa and Mastercard) fees, processing a single payment for multiple journeys. Meanwhile, passengers enjoy guaranteed best-value fares.

2. Reduced operational costs Flexible fare structures

Switching to contactless EMV payments cuts the cost of issuing paper tickets and smart cards; and of staffing and maintaining ticket offices and kiosks.

3. Minimised loss/maximised revenue

Our platform handles fare authorisation and settlement in a secure, PCI-Level 1 certified environment. With near real-time deny lists and automatic debt recovery, it minimises losses through declined payments or fraud.

4. Seamless multi-operator schemes

Our award-winning ‘multi-operator capping’ technology can be used to apply caps over multiple operators’ fare structures. Passengers can use cooperating services, tapping on and off, automatically paying the cheapest fare for their combined journeys.

5. Data-led optimisation

Transit agencies can use Littlepay Control to view transactions, manage product rules and customer service, and gain insight into passengers’ purchasing and travelling behaviour. Through analysis and reporting, they can refine customer-focused products and services.

Benefits of contactless EMV payments – for passengers:

1. Passenger experience

Almost half (49%) of UK commuters view the introduction of contactless payments as the single most significant improvement to their overall public transport experience.

2. Ticket-free convenience

Passengers are quick to adopt contactless EMV payments, enjoying the convenience of paying with the bank card or digital wallet they carry everywhere.

3. Trackable spending

Passengers who ‘tap to pay’ appreciate being able to track their fare payments using a customer portal. Littlepay provides a white-labelled portal called Littlepay Traveller.

4. Reduced queuing time

With contactless EMV payments, there’s no need to queue for tickets or handle cash. The fast, frictionless payment experience means less congestion and faster boarding.

5. Value guaranteed

Passengers don’t need to analyse ticket prices. With contactless EMV fare capping, many journeys are automatically combined into one value-for-money fare.

6. Minimal contact

Reduced driver interaction and zero contact with payment infrastructure minimises the risk for both passengers and drivers of exposure to Covid-19.

Trending Topics

Project Highlights: Washington DC’s record breaking upgrade to accept open loop payments

Nevada County Connects leverages Cal-ITP’s Mobility Marketplace to elevate the payment experience across its bus network

Insight

Insight

Knowledge

Knowledge

News

News