Contactless Payment 101: Everything You Need To Know

by Andreea

In this digital-led world, contactless payments are a popular choice for all kinds of transactions. From grocery shopping to commuting, the convenience and speed offered by this technology are transforming how we handle money. However, what is contactless payment and how do contactless payments work? In this latest article, we thought we would take a closer look at those questions and more, demystifying the world of contactless payment!

What is contactless payment?

Contactless payment is the secure method of purchasing services or products via a debit, credit, or smart card. In more recent years, this has expanded to include devices like smartphones and wearables with Near Field Communication (NFC) or Radio-Frequency Identification (RFID) technology. Using this smart technology removes the need for any form of physical contact traditionally required by card swiping.

The evolution from cash to digital payments has been incredibly quick. Physical cash has been the preferred method of selling goods and services for thousands of years. That began to change in the mid-late 20th century as the popularity of debit and credit cards surged. This expanded further with the invention of the Internet, which introduced online banking and payment capabilities. More recently, this has evolved further with the introduction of NFC and RFID technology. These advancements are transforming transactions and helping to unlock a world of convenience and security.

When answering the question, “What is contactless payment?” it is important to understand the two key methods utilised. NFC is incredibly popular and allows two devices to exchange data when placed close to each other. On the other hand, RFID uses electromagnetic fields to identify and track tags that are attached to specific payments. It’s also worth mentioning QR codes here, as while not entirely contactless, they do offer a simple way to process payments by scanning a code on a smartphone or paper.

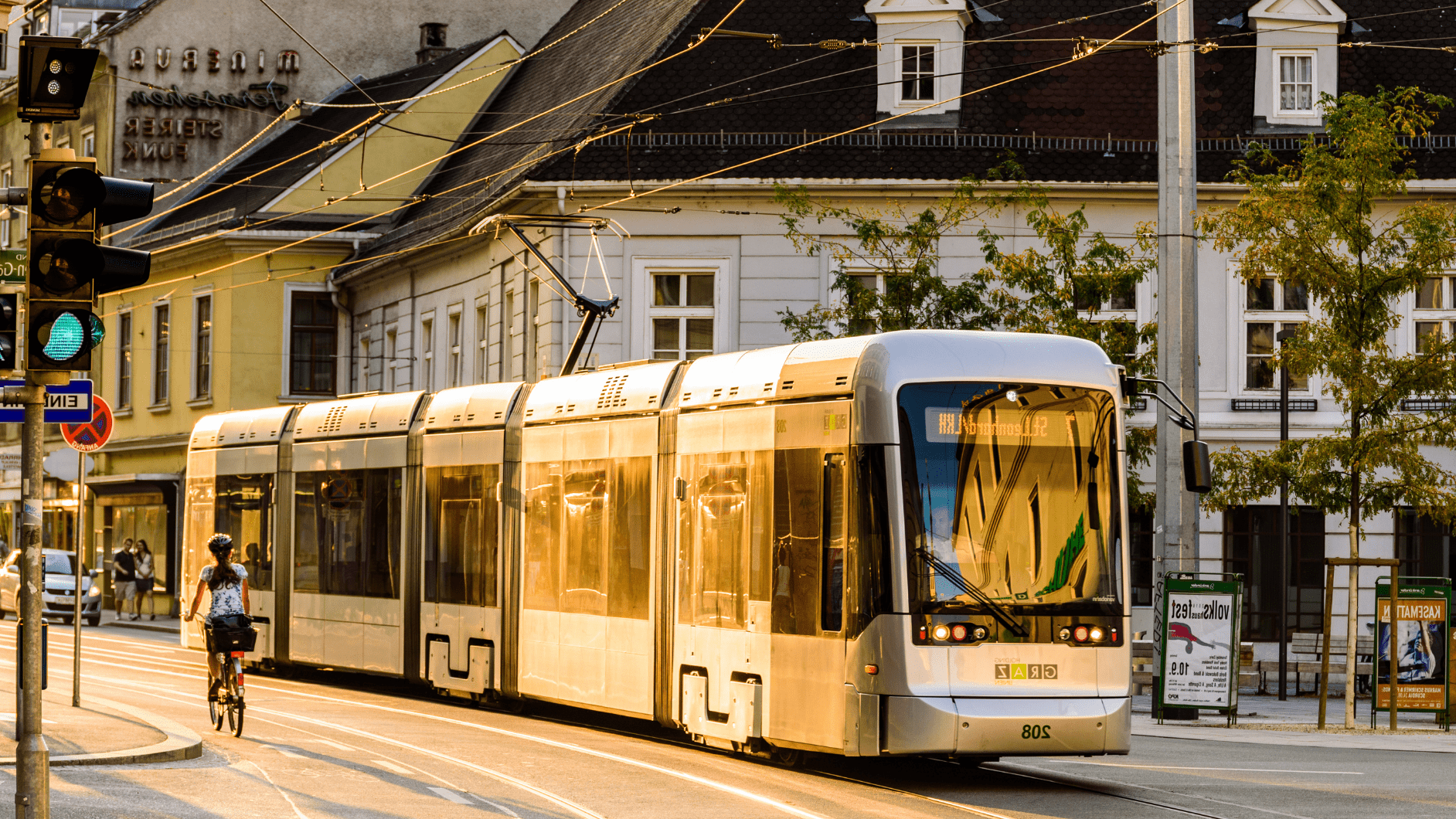

How does contactless payment work in transit?

Almost every aspect of the retail and commercial goods industry now uses some form of contactless payment, and the world of transit is no different. For commuter hubs and transport routes, NFC is the cornerstone of these systems, allowing two devices to communicate when within a few centimetres of each other.

So, how do contactless payments work? When a device (be it a card, smartphone, or wearable) communicates with a reader, it receives a signal that indicates payment is required. The device then responds with the required information, completing the transaction. All of this communication happens in nanoseconds and is fully encrypted to ensure security.

The speed and convenience contactless provides has seen it quickly adopted in cities across the globe. London, New York, Sydney, and more have all integrated these into their transit networks, transforming how people get around.

Using contactless payments is incredibly straightforward:

Tapping in and out

Passengers simply need to tap their contactless card or device on the specified reader when boarding or alighting. The system will recognise the device and the fare is automatically calculated and deducted.

Linking payment methods

Another option is to allow users to link their payment methods to a secure token connected to the transit system’s back office. This allows passengers to pay via multiple methods while unlocking a range of additional benefits, such as discounted travel for eligible groups. For example, a veteran would be able to use open-loop and closed-loop methods to pay for his trips and still be able to benefit from discounted fares.

Are contactless payments secure?

One of the most common questions when looking at how contactless payment works is about security. This is a major concern for any form of digital transaction, but fortunately, these payments feature multiple layers of security.

Here is how passenger information stays safe:

Encryption

All data transmitted during a contactless transaction is encrypted, making it incredibly tough for unauthorised parties to access it.

Limited range

Finally, NFC requires close proximity to the payment device. This significantly reduces the risk of interception.

What are the benefits of contactless payments for passengers?

Now we have explored the question of “How does contactless payment work?” let’s turn our attention to some of the benefits. Implementing contactless payments across transit systems can transform the process for passengers. Some of the biggest include:

Convenience and speed

One of the biggest advantages of implementing contactless payment is the speed. Passengers will no longer need to fumble with cash or queue for a machine. Instead, they can simply tap in and continue their journey.

No physical ticket

Everything being handled electronically means there is no need for a physical paper ticket, reducing the risk of losing a ticket and having to pay again.

Efficient Travel

Seamless transactions help to reduce queues and delays, creating an efficient, seamless and stress-free commuting experience.

Uncomplicated

Adopting contactless payments also makes the process far more efficient for passengers. Travellers can use either a credit or debit card, their smartphone, or their wearable to tap in and out, with all fares calculated automatically.

What are the benefits of contactless payments for transit agencies?

Of course, it’s not just passengers who can benefit. Contactless payments are just as advantageous for transit agencies, with some of the biggest including:

Improved efficiency and reduced operational costs

With less cash handling and fewer paper tickets, it helps to significantly improve efficiency and reduce operational and processing costs. A smoother experience for passengers and a more user-friendly process can help to encourage increased ridership.

Better data collection and analytics

Digital transactions provide far greater insights and data than paper tickets. Transit agencies will be able to use this insight to improve services and better optimise routes.

Enhanced security

The encrypted nature of contactless payments makes them more secure than cash or traditional magnetic stripe cards.

Lower carbon emissions

Contactless payment can also help transit agencies to lower their carbon emissions. Alongside reducing the need for physical materials such as paper, it also speeds up boarding time, particularly on buses. This reduces idling time, which lowers greenhouse gases emissions.

Potential challenges of implementing contactless payments

There can be no denying the many benefits that this technology can bring. However, no article exploring the question “How does contactless payment work?” would be complete without touching upon some of the challenges posed.

One of the most significant is the infrastructure upgrades required to utilise the technology. Transit hubs without any existing devices will require new payment readers that are compatible with various contactless methods. However, for those agencies that do will just need to make them EMV ready with plug-in solutions like Planeta Informatica’s VASM. While these options do require some initial investment, the cost savings that come from its implementation will recuperate the expenses in the long term.

While this technology offers exceptional security, as with all payments, it is not immune to security or privacy concerns. Transit businesses will need to mitigate the risk of data breaches, skimming attacks, and unauthorised access to payment information. This requires the implementation of robust encryption and security protocols to protect all users.

Transitioning to a new payment system requires users to adapt to and adopt new technology. This can be particularly challenging for segments of the population who are less tech-savvy or have limited access to digital devices. Public awareness campaigns and user education programs can address concerns and misconceptions.

Implementing a new payment system can also cause temporary operational disruptions. Transit agencies must effectively manage the installation of new equipment, testing phases, and the transition period to minimise passengers’ inconvenience.

Ensuring that contactless payment systems are accessible and inclusive is crucial. Not all passengers will have access to contactless-enabled devices or bank accounts, so alternative payment methods will still need to be featured.

Yet, while these are potential challenges that may arise, careful planning and collaboration with technical partners mean they can be easily addressed. By anticipating and mitigating these issues, transit agencies can successfully implement contactless payments and unlock the benefits of a modern, efficient, and user-friendly payment system.

Final thoughts

In recent years, contactless payments have become the norm for countless industries around the world, and transit has been no exception. In this blog, we have answered the question of “what is contactless payment?” and explored some of the biggest benefits and potential challenges that may arise. As technology continues to advance, embracing this technology is vital for businesses looking to succeed.

Want to find out more? Download our eBook about the fundamentals of transit payments.

Insight

Insight

Knowledge

Knowledge

News

News