How Mobile Payment Solutions Are Transforming Public Transportation

by Andreea

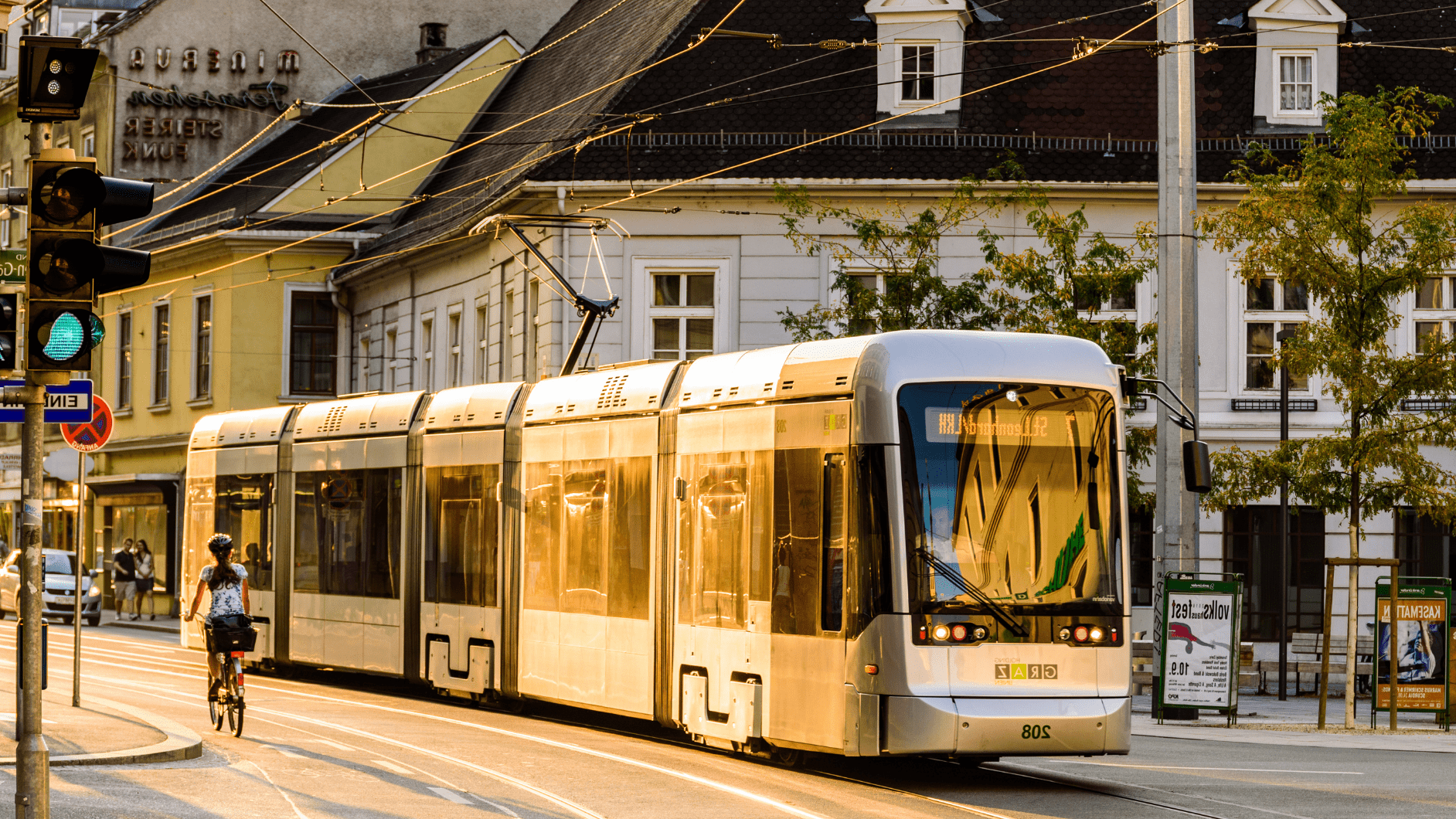

Public transportation is evolving, and mobile payments are at the heart of this transformation. As the digital revolution continues, the days of fumbling for change or standing in long lines to purchase tickets are long gone.

Mobile payment solutions are helping to make transit systems more efficient, more accessible, and far more user-friendly. What exactly is mobile ticketing, though? In this latest article, we explore what mobile payments are, how they work in terms of public transit, the different types available, and the benefits they bring to riders and transit authorities alike.

What are mobile payments in transit?

Mobile payments in transit refer to digital payment methods that allow passengers to pay for their transport fares using their mobile devices instead of cash or physical tickets. This modern approach does away with the traditional solutions and helps to drastically enhance convenience for passengers, improve overall operational efficiency, and streamline the payment processes for both riders and transit operators.

With mobile payment solutions, passengers are able to use their smartphones, smartwatches, or other smart mobile device to pay instantly via mobile wallets and contactless credit and debit cards. This ease of payment helps to significantly reduce wait times by eliminating the need to queue for a physical ticket, allowing far quicker transit through stations.

As more cities adopt mobile ticketing and digital wallet integrations, transit networks are becoming smarter and more accessible. This offers a seamless travel experience for commuters while also optimizing the overall efficiency for transit operators.

What are the different types of mobile payments in transit?

There are several types of mobile payment solutions used in transit networks, with each option offering a range of unique benefits to both riders and transit operators. Some of the most common include:

QR code payments

With this method, passengers receive a unique QR code on their mobile device, which they can then scan at ticket validation points to board buses, trains, metros, or any other form of public transport. These codes are also very cost-effective and easy to implement, especially in those regions where NFC infrastructure is still developing.

Some of the biggest benefits include:

- Works without internet access once the ticket is generated.

- Simple and cost-effective to implement.

- Eliminates the need for paper tickets.

Mobile wallets

Digital wallets like Apple Pay, Google Pay, or Samsung Pay allow passengers to store their payment details securely on their mobile devices, which they can then use to pay for transit fares. These mobile payments enable riders to simply tap their phone or smartwatch at a contactless terminal and complete their journey.

Some of the biggest benefits include:

- Fast and secure transactions.

- Removes the need for a separate card or app.

- Compatible with most modern smartphones and wearables.

Mobility as a Service (MaaS)

Mobility as a Service (MaaS) apps integrate multiple transport services into one simple platform. This allows passengers to plan routes, purchase tickets, and track transit schedules in a single app.

Some of the biggest benefits include:

- Ability to combine multiple transportation options.

- Real-time travel updates and ticketing in a single app.

- Flexible pricing and subscription models for frequent riders.

Contactless EMV (Euro Mastercard Visa) payments

This solution allows riders to use their credit or debit card (or a mobile wallet linked to their bank account) to pay fares directly by tapping at a designated terminal. Many cities around the world already use this solution to streamline their transit payments, including London, New York and Sydney.

Some of the biggest benefits include:

- No need to pre-load funds or buy tickets in advance.

- Works with existing banking infrastructure.

- Reduces the risk of fraud and lowers operational costs.

What are the benefits of mobile payments for riders?

Mobile payment solutions help to make public transportation much more convenient, secure, and efficient for passengers, and some of the biggest advantages for riders include:

- Convenience and speed

One of the biggest advantages of utilizing contactless mobile payment solutions is the convenience and speed that it provides. Mobile payments eliminate the need for passengers to carry cash, coins, and physical tickets, allowing them to quickly access transit options by making quick payments via their smartphones, smart watches, or contactless credit cards.

That instant payment also eliminates the need to queue up at ticket booths or vending machines, ensuring much swifter journeys.

- Faster boarding

Alongside reducing the time it takes to purchase tickets, mobile payment solutions also ensure faster boarding. Passengers just need to tap their phone or scan the QR code to enter the transit system, reducing congestion at busy stations.

- Enhanced security

Mobile payments offer far greater security, with digital wallets using encryption and biometric authentication to complete transactions. This reduces the risk of fraud as well as removing the risk of lost or stolen tickets.

- Seamless travel

Mobile ticketing apps allow users to plan their routes, check real-time schedules, and purchase tickets, all from one single app or website. Alongside the ease of use, these systems also feature additional benefits, such as fare capping, which ensures that passengers always get the best pricing without the need for extensive searching,

- Multiple payment options

Contactless mobile payment solutions offer riders the ability to pay using multiple payment options, including QR codes, mobile wallets, contactless EMV cards, and MaaS apps. This provides passengers with a far greater level of flexibility in how and when their fares are paid.

What are the benefits of mobile payments for transit authorities?

Of course, mobile payment solutions do not just offer benefits for passengers. Transit agencies will also find a huge range of benefits, from improving efficiency to increasing passenger numbers. Some of the biggest of these include:

- Lower operational costs

One of the major advantages of adopting mobile payment solutions is that it helps to reduce the need for paper tickets, ticket vending machines, and cash handling. This minimizes the costs typically associated with ticket production, distribution, and maintenance, ensuring that transit authorities are able to save money.

- Increased efficiency and faster transactions

Mobile payments also speed up boarding times, which helps to reduce delays and improve overall service efficiency. This creates less congestion at ticket counters and fare collection points, helping to make smoother journeys and transactions.

- Improved revenue collection and fraud protection

Digital wallets and mobile ticketing help to significantly reduce the risk of fare evasion and counterfeit tickets. The use of contactless mobile payment solutions ensures accurate fare collection and automated tracking, which when combined with fare capping, encourages more individuals to use public transport and encourages repeat travel.

- Access to valuable data and insights

Transit authorities can analyze mobile payment data to identify travel patterns, peak hours, and rider preferences. These insights can then be used to help improve route planning, scheduling, and pricing strategies to minimize expenditure and maximize profits.

- Enhanced rider satisfaction and adoption rates

A seamless and modern mobile payment solution encourages more people to use public transport by providing real-time insight and the ability to plan trips across multiple transport options. This helps reduce the number of vehicles on the road and encourages greater use of trains, subways, and buses.

- Future-proof and scalable payment solutions

Finally, mobile ticketing can be easily integrated with new technologies such as artificial intelligence, blockchain, and biometric authentication. This allows it to be easily adapted and scaled to meet the growing needs of the transit authority.

The future of mobile payment solutions

The future of mobile payment solutions in public transport is only set to become more innovative, seamless, and integrated as cities continue to embrace smart infrastructure. Advancements in technology will also help to enhance security, efficiency, and convenience for both riders and transit authorities alike.

Artificial intelligence is also going to play a major role in the advancement of these systems. It is capable of analyzing commuter behavior, allowing it to adjust fares dynamically and cap fares, ensuring riders are able to always get the best fares based on their travel history.

How to set up mobile payment systems for public transit

There can be no denying the vast array of benefits that mobile payment solutions can bring to both transit authorities and passengers alike. However, it can also seem a complex process to implement. Thankfully, there are several systems available to help operators implement these systems.

The first is to partner with mobile wallet providers, such as Google Pay and Apple Pay. This will allow authorities to enable tap-and-go payments, letting commuters to pay for devices directly from their mobiles or wearables. The second option is to utilize MaaS platforms like UrbanThings and Passenger, which allow passengers to plan routes, buy mobile bus tickets and receive regular service updates. The third option is to implement Littlepay eCommerce as an addition to contactless EMV payments, which allows riders to enjoy the flexibility of connected online and contactless payment channels. We have been providing transit authorities across the globe with an express route to contactless and mobile payment acceptance on local buses, city networks, and national transport systems.

Want to learn more? Get in touch today and join over 400 transport and mobility providers around the world!

Trending Topics

Project Highlights: Washington DC’s record breaking upgrade to accept open loop payments

Nevada County Connects leverages Cal-ITP’s Mobility Marketplace to elevate the payment experience across its bus network

Insight

Insight

Knowledge

Knowledge

News

News