Open Loop Versus Closed Loop Vs Open Loop System for Fare Collection

by Andreea

Five years from now, will paper tickets be retro? Will QR-codes be archaic, and smart cards a quaint relic from transit payments’ archives? Will people carry actual wallets anymore? Or will smart devices be the only thing we need to shop and pay for everything, from food to transit? The debate between closed loop vs open loop fare collection rages on.

Cash remains entrenched in the fare collection ecosystem today. However, we can see a tomorrow not far off when the transit payments landscape could look simpler. One payment method for all your travel, shopping and other spending – the bank card or mobile wallet you carry everywhere.

The future of mobility payments

The industry continues to debate where the future of transit and mobility payments lies. However, most transit operators agree that cash is no longer king. Expensive to handle and process, transaction times are slow and this leads to long dwell times, station congestion and boarding bottlenecks.

For years, the smart money has been on contactless payments displacing cash in public transit, bringing convenience and ultra-fast transaction speeds. They can process more efficiently than cash, and the system traces transactions, reducing the burden on customer service centers.

The question is which contactless payment method should transit operators provide to become riders’ go-to solution for fast, frictionless fare payments? Thus this post looks at two of the contenders: closed vs open loop.

Closed loop smart cards

Transit operators and authorities typically issue closed-loop smart cards. Therefore, users can only use these within the private ticketing system. Some transit smart cards interact offline with devices onboard vehicles. While others act as tokens, working in tandem with a back office.

Outside of Account Based Ticketing (ABT), a closed loop payment system that can work offline requires smart cards to have more logic on the card. As a result, the system needs specialized devices to validate the cards, enforce security, and update their stored value or pre-loaded ticket at the point of use. These devices deduct a fare or validate a ticket when the passenger taps to board a vehicle.

In an ABT system, the smart card is an identifier to uniquely log passengers’ access to a transit network. Thus, the system makes decisions about what to charge centrally in a back office. This is based on information associated with their account, which the system collects when they tap into the closed-loop payment system. This might include their eligibility for concessions, or details of any period passes held.

Open loop EMV cards

In open loop EMV fare collection systems, passengers can use their bank-issued contactless credit or debit card; prepaid EMV card; mobile wallet; or smart device, to pay for journeys. This means there are no costs associated with issuing or replacing cards, as this is handled by banks.

Open loop payment methods can be used to pay within many different systems (pretty much anywhere these days). These are funded by a centralised payment source, such as a bank or credit card account. Unlike closed loop cards, they don’t require a prepaid amount to exist in the system.

Passengers tap their contactless card, or contactless-enabled smartphone or wearable, on a payment reader to validate it and access transit services. That tap is processed by a back office, which handles aggregation, fare calculation and settlement through the banking network. Depending on the fare rules configured by the transit operator, taps may be aggregated over a given period and fare caps applied, so passengers automatically pay the best value fare.

Closed loop and open loop in ABT systems

Smart cards’ dominance in transit ticketing has been challenged in recent years, as other payment technologies have emerged and gained popularity. It has become clear that there is no one-size-fits-all solution. This has led to increasing adoption of centralised ABT systems. With a single view of a customer, they can have one or more different types of identifiers linked to it – which could be a smart card, QR code or an EMV card.

A passenger using an ABT transit ticketing system taps or presents their supported token to travel. The data associated with that tap is used by the ABT back office to calculate the charge for that trip.

A key benefit of an ABT solution is that any logic can be applied in the cloud to determine the amount to be charged. In addition, validator devices can be simpler and cheaper, as their role is limited to accepting a tap from a supported token. All the complexities around fares, capping and discount entitlement are managed in the cloud.

Stored-value, card-centric, closed loop payments schemes work offline. Therefore they provide a solution to eliminate the losses incurred when poor connectivity causes downtime in ticketing solutions. Now EMV transit specifications also allow for offline authentication and processing. Therefore there is greater interest in ABT systems using a variety of tokens to travel. They can offer two of riders’ most important must-haves – value and payment choice.

Which contactless system is best for transit?

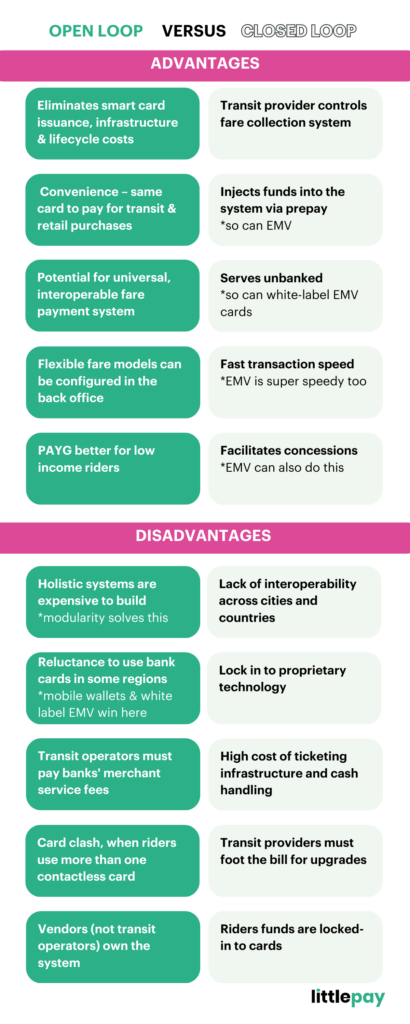

As the closed loop versus open loop brigades continue to debate between themselves, we see many large transit operators around the world promoting their use of one, the other, or both. Here are some of the pros and cons:

Open loop EMV pros

Eliminates smart card issuance, infrastructure & lifecycle costs

EMV cards are issued by banks not transit operators, so issuance and replacement costs are nil. In systems where closed loop infrastructure is being phased out, the cost of maintaining ticketing kiosks and of handling cash can be greatly reduced.

Convenience – same card to pay for transit & retail purchases

Passengers can use the bank card or mobile wallet they carry everywhere to pay for public transit trips. For low-income riders in particular, it can be a benefit to pay-as-they-go using their bank card, rather than locking funds into prepaid smart cards.

Potential for universal, interoperable fare payment systems

With cEMV becoming more widely used for transit payments in cities all around the world, there’s potential for fare payment systems to be the same wherever you are. In addition, technology now exists to layer multi-operator fare caps over individual operators’ fare structures to unify the rider experience across a local authority, state, or country.

Flexible fare models configured in the back office

Ticketing complexity is one of riders’ perpetual bugbears with public transportation. With EMV, fare systems can be configured to offer simple flat fares, fare caps and discounts. The best fare is automatically calculated within the back office. For the rider the experience is effortless.

Open loop EMV cons

Holistic systems are expensive to build

Proprietary open loop EMV systems can be complex and costly to build. However, procuring a modular solution using multiple specialist vendors whose solutions plug-and-play together results in a more competitive marketplace and simple deployment.

Perceived to be less inclusive

Historically, open loop EMV has been viewed as excluding riders who don’t have a bank account and an associated card. This is not the case today, however, as simple solutions such as white-label EMV cards now exist that enable operators to include unbanked riders in an open loop system.

Bank fees

When using open loop platforms, transit operators must pay acquiring banks’ merchant service fees. However, other savings can offset these costs. For instance, less cash handling and lower operational expenses (e.g. ticket office and kiosk maintenance).

Vendors own the system

Some transit operators fear loss of control when they don’t own the payment system. Working with multiple vendors providing a modular solution alleviates this issue, rather than relying entirely on a single vendor. Building-in stakeholder responsibility and accountability at the contract stage is vital. Procuring a solution that’s flexible and adaptable to emerging technologies can further alleviate risk.

Closed loop smart card pros

Ownership of the fare collection system

The transit operator owns and controls the smart card fare collection system.

Prepay ‘float’

As passengers often pre-pay and load funds onto their smart cards, this injects funds into transit operators’ accounts.

Equitable fare payment

Closed loop payments systems do not exclude the unbanked, underbanked (or unwilling to use bank cards).

Fast transaction and boarding times

When smart cards are processed offline – and a ticket has already been loaded, or value stored on the card, transaction times are ultra-fast and much quicker than cash.

Facilitates concessions

In an ABT system, users link smart cards to their individual accounts as tokens. The account can hold information such as eligibility for discounts and concessions (such as student or senior status). This is also the case when an EMV card is used as a token for travel.

Closed loop smart card cons

Lack of interoperability across cities and countries

Closed loop smart cards can’t easily be combined within a standardised interoperable platform.

Lock-in to proprietary technology

Transit operators are often locked-in to technology that has been built from scratch by a single vendor.

High cost of ticketing infrastructure and cash handling

The cost of purchasing and installing new equipment and producing and distributing plastic transit cards can be steep. Therefore operators must also maintain ticket sales desks and kiosks, for passengers to buy and top-up smart cards

Transit providers must foot the bill for upgrades

As new technology emerges, ticketing systems can become outdated and require upgrading. In this context, the hurdle of steep cost can be a hindrance to agility and ticketing innovation.

Prepay cards lock-in riders’ funds

Paying for travel in advance can be a struggle for lower-income riders.

Improving passenger experience

As the open loop vs closed loop transit payments rages on, the adoption of contactless EMV transit payments continues to rocket in many countries, some of the most persistent concerns about deploying open-loop EMV systems are crumbling. Technology is advancing, rapidly opening up more rider-focused functionality.

What if EMV fare collection could allow prepayment, providing access to reservations, concessions and period passes? Could it cater for the unbanked? What if the same contactless card could be used for PAYG and mobile payments? What if this unified payment experience unlocked a channel for valuable, real-time rider notifications?

As future blog posts will explore, we’ve reached a juncture where all this is possible. It will be interesting to see whether these innovations will be the catalyst for contactless open loop fare collection becoming the number one choice to displace cash from the transit system – or will the open loop versus closed loop discussion rumble on?

Trending Topics

Project Highlights: Washington DC’s record breaking upgrade to accept open loop payments

Nevada County Connects leverages Cal-ITP’s Mobility Marketplace to elevate the payment experience across its bus network

Insight

Insight

Knowledge

Knowledge

News

News