Open loop convenience is the future of transit payments

by Andreea

The way we make purchases has undergone immense, rapid change in recent years. Open loop payments have made paying for goods and services more convenient than ever, from contactless cards to phone or smartwatch taps.

On public transport, tap-to-pay is becoming the norm in many cities, but the experience is far from universal. In some parts of the world, both urban and rural, cash remains the most common way to pay. In others, there is a bewildering mixture of cash, physical tickets, travel cards and QR codes.

If making transit networks more convenient, attractive and accessible is a priority, contactless open loop ticketing is the key.

The road to contactless open loop ticketing has already begun

We’ve travelled a long way on the road to contactless payments already. Visa, Mastercard and American Express introduced their first contactless cards in 2008. Now, almost every modern card reader comes ready to accept payments with a tap. From large stores to independent food vendors and even musicians busking on the street, contactless payments are everywhere.

That trajectory towards the proliferation of contactless was in place long before the events of 2020. But when the Covid-19 pandemic hit and the world population shied away from potentially contagious surfaces, adoption of contactless payments soared among consumers and merchants alike.

In Q1 2020, Mastercard reported a 40% surge in contactless payments, while Visa witnessed contactless transactions doubled across Europe. In the US, 19% of consumers used a contactless method for the first time in May 2020.

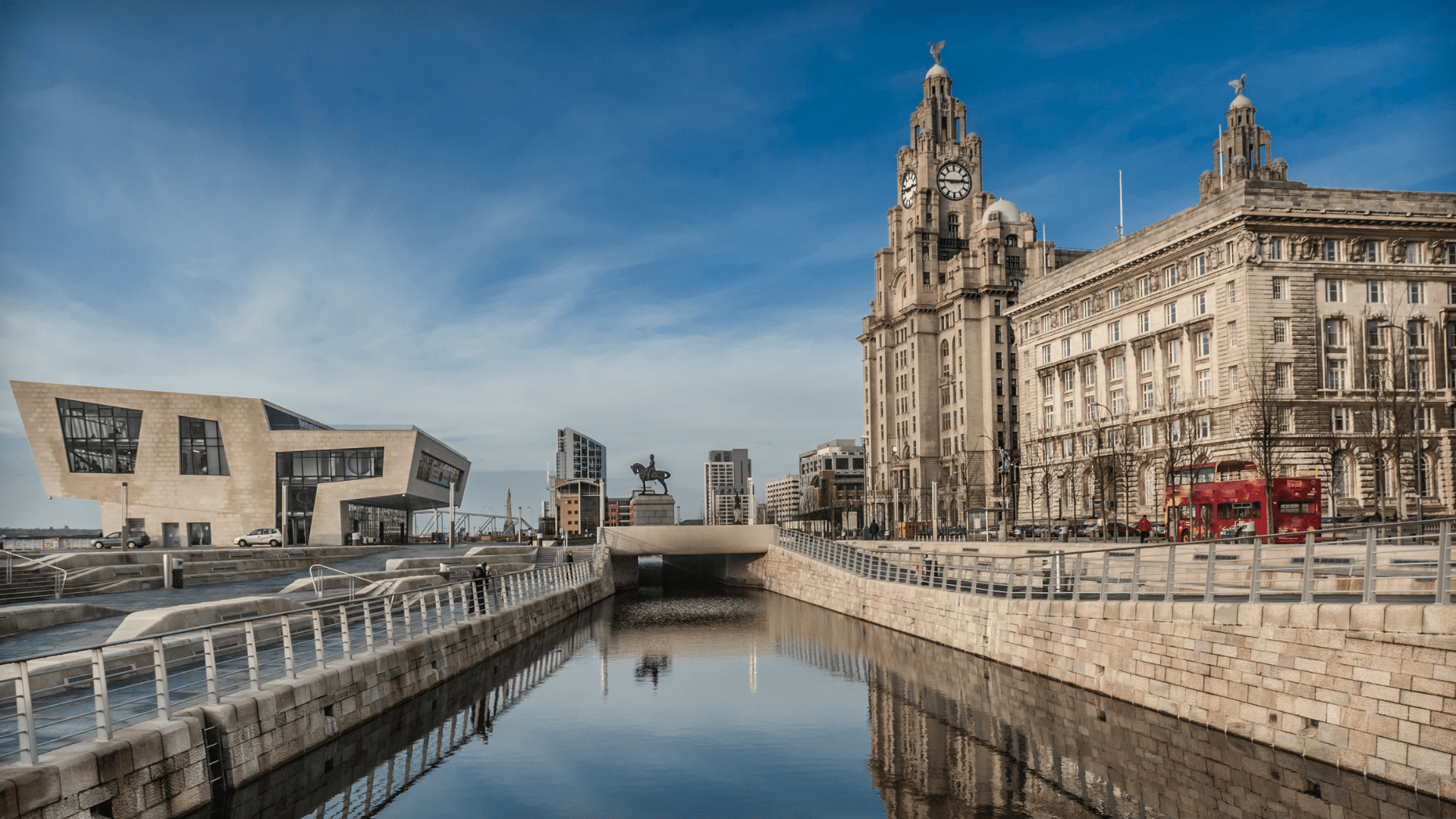

It’s not just retail that’s taking advantage of contactless technology. Transport for London (TfL) led the industry forerunner by introducing contactless payments in its bus, rail, and subway network. This payment strategy provides convenient tap on, tap off for passengers and has become a pillar of TfL’s revenue.

In 2021 contactless payments made up 70% of the network’s pay as you go ticketing, while by April 2022 contactless fare revenue had already returned to pre-pandemic levels despite a considerable shift in working and commuting habits. As a result of TfL’s success, the UK government is planning to implement similar systems nationwide by 2030.

Perceived barriers to open loop transit payments often don’t exist

Many cities have followed TfL’s lead by offering contactless transit payments to passengers, and they are proving that passengers love the ease and convenience of tap-to-pay. However the transit industry at large isn’t yet ready for full-scale adoption.

In the US for example, small and medium-sized operators don’t have the resources to procure a bespoke system. They are also acutely aware of the importance of maintaining the option to pay with cash, for the many unbanked or underbanked people who depend on public transit in their communities.

In other parts of the world, Latin America and Asia Pacific for instance, there has been heavy investment by transport authorities in ticketing infrastructure for closed loop transit cards. There is a general misconception that they would have to ‘start over’ with open loop payments, with the headache and cost of buying new hardware and software.

In reality, procuring a modular system can solve many of the perceived hurdles between transit operators and contactless EMV payments. Littlepay’s payments platform, for instance, involves very little upfront cost. It seamlessly integrates with any cEMV compatible validator and can integrate into existing back offices, effectively offering a contactless payments module that easily fits into the existing infrastructure.

Transit payments are a unique beast – the response must be too

Transit also faces very unique hurdles for contactless ticketing. In the retail world, contactless transactions are a relatively simple concept. Prices are known at the point of purchase, and any discounts, reductions or offers are applied by scanning a barcode. When a customer taps their card, their bank simply verifies that sufficient funds are available in their account.

With public transport, those values aren’t as clear cut. Travellers don’t have barcodes that tell a station gate when they’re eligible for concessionary fares, and the cost of a journey might remain unknown until its end point. And while retail stores can afford a two or three second delay for authorising payments, the tight schedules that govern public transit narrow that window to just 300 milliseconds.

With such short verification times, unknown values, and the need to take payments in remote, offline areas, risk management is critical. If a payment fails verification, the ticketing system needs a way of chasing it so that the operator doesn’t lose revenue.

In the past, closed loop systems were proposed as the answer to these challenges. Schemes such as London’s Oyster and Sydney’s Opal opened up tap-and-pay travel with a prepaid contactless card. But despite their success, these systems still fall short of the convenience of contactless open loop ticketing.

Passengers still need to estimate fares when topping up and carry multiple cards if traveling outside the closed loop. For transit operators, these systems also carry a high operational burden for issuing cards and maintaining physical top-up kiosks.

Open Loop Ticketing Makes for Effortless Travel Payments

Making travel payments truly effortless means removing the thought process around buying a ticket – and allowing passengers simply to pay for the journeys they take. With an open loop system, passengers don’t need to carry multiple cards that only operate on certain networks. Their regular bank card or digital wallet suffices no matter where they travel, eliminating the need for additional items.

In a back office, the system calculates the cost of their travel – and if fare capping rules are in effect – it automatically charges them the best value fare for the trips they take.

A toolkit for a new future of transit

Transit can no longer afford to be the last bastion of cash. With the world embracing a tap-to-pay landscape, public transport will be expected to fall in line and enable travellers to tap onto transport with the same card they used to buy their coffee at the station.

That will mean evolving beyond legacy closed loop systems. With an open loop ticketing solution built with the industry’s challenges in mind, complex fares, caps and concessions can be automatically applied, individual taps for multiple journeys can be aggregated together, and debt recovery can be built in to ensure no loss of revenue.

The design and build approach favoured by big cities for open loop ticketing is unattainable for most transit agencies. But with a modular framework like Littlepay, operators can implement adaptable contactless ticketing without building everything from scratch.

The right components for each setting can be slotted in without needing a complete redesign, and systems can be ready to deploy in a matter of weeks.

To learn more about the future of contactless payments for public transport, read our second blog in the series on how contactless transit payments can unlock long term benefits.

Insight

Insight

Knowledge

Knowledge

News

News