The future of transit payments is contactless EMV

by Andreea

Open loop contactless payments can solve many of the problems facing mass transit

Simplicity, interoperability and inclusion. At every urban mobility conference, these topics in payments and ticketing are always front and centre. The debate revolves around how to make fare systems seamless across multimodal networks and accessible to everyone in society.

Mobility-as-a-service (MaaS) is touted as the solution. The definition being a single application that enables journey planning, fare payments and real-time travel information. MaaS, it’s suggested, can unify regional transport and make the experience of local travel seamless.

MaaS is ambitious, as authorities attempting to achieve it will agree. It needs collaboration between stakeholder groups; free flow of data; and integration between ticketing, payments and information technology. The epic scope of MaaS is causing it to stall.

There is another route that starts small and scales. It begins with the introduction of contactless open loop fare collection and builds up from that foundation.

A simple start: introducing contactless

Contactless open loop systems allow transit users to pay for trips with a contactless bank card or smart device. They make paying for transit as simple as paying for a cup of coffee.

Passengers tap a card reader with their bank card or phone as they board a vehicle and a cloud-based back office handles fare calculation. If they travel more than once, card taps are grouped together and a single charge is applied for the journeys they take.

In contrast, paying by cash or with a reloadable closed loop transit card needs planning. It takes time to weigh up ticket prices and find the best value option. Passengers must make sure they have enough money in their pocket, or loaded onto their card.

Tap-to-pay transit speeds things up. Tapping, rather than paying in cash, shaves 1.75 seconds off boarding time; and time-saving increases to 2.25 seconds versus swiping a card. Dwell times are reduced, which is good news for passengers, operators and city traffic.

By creating a simpler, faster passenger experience, operators deepen customer satisfaction, inspiring more frequent travel by existing users and attracting new people to use the system. London Transport reported 4% ridership growth in the year following its contactless rollout.

Reducing cash in transit networks also cuts the expense of cash handling. Washington D.C., for example, saved 6 cents per dollar collecting fares by bank cards rather than in cash. There’s also an opportunity to phase out closed loop systems, lowering the cost of manufacturing and issuing cards, maintaining hardware, and managing ticket booths.

The next level: fare caps

With a contactless EMV system, transit operators have many tools to keep fare payments simple. One of the most powerful is fare capping, a type of fare rule that can be set-up in a contactless back office to bring value to customers, building trust and loyalty.

Daily and weekly caps provide similar benefits to a period pass. A maximum fare is set for a given time period. When the cost of trips taken during that time reaches the maximum, no more charges are applied, and further travel is free.

Time-based caps are fare rules that last for a specific length of time, and have a useful application for commuters. When a 60 minute cap is applied, a passenger can make transfers in that time, tapping their card on several vehicles, but will only be charged a set fare.

Flexible fare caps meet the needs of travellers with hybrid work patterns. In this instance, when there is a tap-on, tap-off contactless system, a fare rule creates incremental discounts each time a passenger travels over a given time period, with value increasing the more they travel.

Top-tier: interoperability

The technology exists to create the effortless transit payment experience across a city or region that’s on every transit authority’s wish list. Multi-operator, multimodal contactless EMV payment schemes with fare capping are already being used successfully in the UK. Combined with intelligent trip planning and real-time information, they make MaaS a reality.

A multi-operator fare cap is a fare rule that limits the amount passengers pay when using participating services. A multi-operator scheme can include several transit agencies or operators offering various transport and mobility modes.

To keep things simple, each operator’s fare model is unchanged. The multi-operator cap, for instance a daily fare cap of £5 when using included services, is overlaid. It only comes into play when the cap criteria are met. Calculations are made within the back-office, and apportionment reports produced, to share fare revenue correctly between operators.

This shifts the passenger’s perception of regional transport. They don’t need to consider ticket prices or which operator’s services they are using. They can use the combination of transport modes that make sense to get from A to B; and trust they will be charged the best value ticket.

With contactless EMV, transparency is a key benefit. There are online portals available to both merchants (transport providers) and their customers, and all parties have a clear view of transactions, payment events (such as declines and refunds), and travel history.

Operators can use this insight to create better, customer-focused services. Passengers appreciate having a self-service channel where they can see their payment and travel records and resolve issues without having to call a customer service line.

Public transit for all

Inclusivity is built into contactless payment systems. As a pay-as-you-go (PAYG) channel, they enable people to use transit without prepayment. For low income riders, who juggle finances every day and depend on public transit to get to work, this can be a great help. If you add fare capping to the mix, their frequent travel can be rewarded by savings on fares.

Contactless EMV is rising to the challenge of how to include the unbanked. Solutions are emerging, including the introduction of reloadable EMV cards and virtual EMV cards that enable third parties (transit authorities) to subsidise travel for disadvantaged rider groups. In this respect, transit is leading the way, bringing the unbanked into the financial ecosystem.

Plug-and-play systems

For transport providers considering introducing contactless open loop payments, there are two routes: specifying and building a proprietary system, or working with suppliers whose ‘best in breed’ technology works within a modular framework.

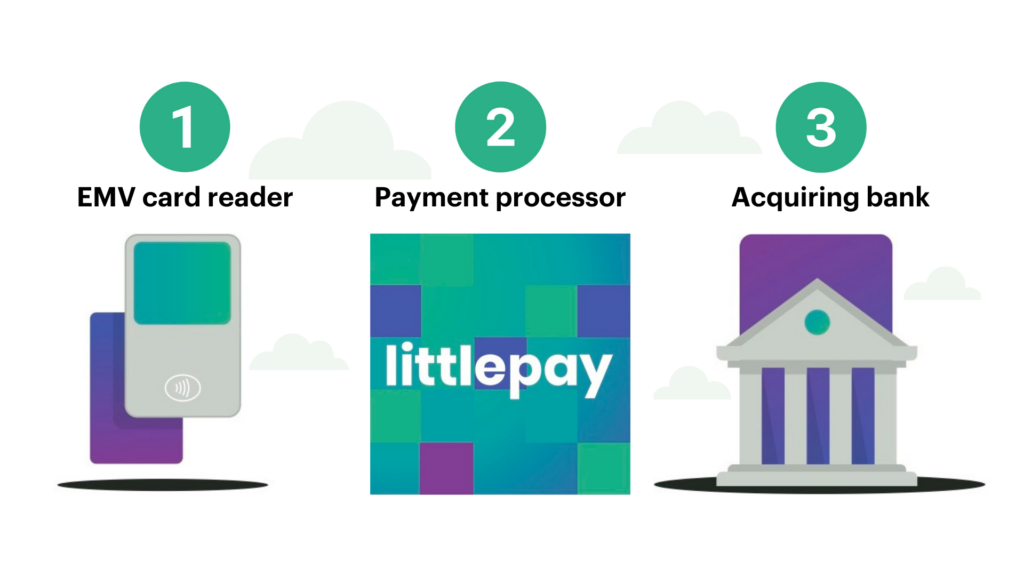

Taking the second approach, all that’s needed to get started is: card readers to validate taps; a transit payment processor; and an acquiring bank to authorise and settle funds. If existing integrations meet the operator’s needs, the system can be up and running in weeks.

Transit operators all over the world are beginning to move away from expensive built-from-scratch systems. Plug-and-pay solutions, like those used in California’s recent contactless demonstrations, are making the technology accessible to smaller operators.

Simplicity, interoperability, inclusion. The buzz words for the future of transit can be achieved when contactless open loop payments play a central role. Using modular systems, agencies can take the express route to bringing riders the MaaS experience.

This article was originally published in Pasajero7, Mexico’s leading transit industry magazine.

To find out more about Littlepay’s modular contactless open loop payments system, get in touch with our team.

To keep up to date with Littlepay news, subscribe to our newsletter.

Trending Topics

Project Highlights: Washington DC’s record breaking upgrade to accept open loop payments

Nevada County Connects leverages Cal-ITP’s Mobility Marketplace to elevate the payment experience across its bus network

Insight

Insight

Knowledge

Knowledge

News

News