UrbanThings and Littlepay join forces to provide MaaS to the masses

by Andreea

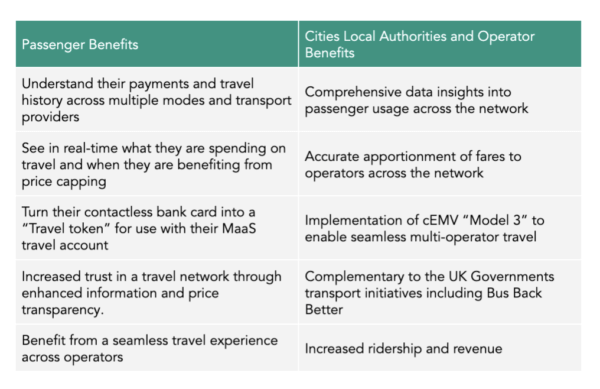

MaaS platform provider UrbanThings and payments infrastructure provider Littlepay have partnered to bring two important innovations to the public transport industry, advancing the potential for MaaS solutions to be more widely used by transport authorities.

Multi-operator, multi-modal interoperability

This exciting move will enable passengers’ multi-operator contactless payments and fare capping activity to be fed by Littlepay into the UrbanThings back office, UrbanHub.

A unique payment token, based on cardholder data received at point of tap, and tokenised to protect cardholder identity, will provide rich insights into passenger travel and payments behaviour across multi-modal transport networks.

This cross-channel view is critical to understanding how transport is used and how services can be optimised to match passenger needs; and is synergistic with the latest governmental initiatives, such as Bus Back Better.

Buy now, tap later

The partnership also allows the UK’s first-ever ‘Buy now, tap later’ transit payment option to be offered to passengers. Using a mobile checkout solution developed by Littlepay, mobile app users will be able to associate their contactless bank card with their MaaS account.

All prepaid journeys, MaaS subscriptions, discounts and even concessionary entitlements can be linked to their payment card, which can be used as their token to travel. This concept is known in the UK as cEMV “Model 3”, or “Card as an Authority to Travel”.

For transport authorities, this consolidates the investment in contactless technology, making it an achievable goal to phase out closed-loop smart cards. In doing so, they can eliminate the cost of issuing thousands of pieces of plastic and maintaining closed loop infrastructure.

For the growing numbers of passengers that regularly use tap-to-pay on transit, it will be a game-changer to be able to access MaaS benefits without changing their payments behaviour. They can use what they already carry in their pocket, their contactless bank card or mobile wallet, for all their ticketing needs.

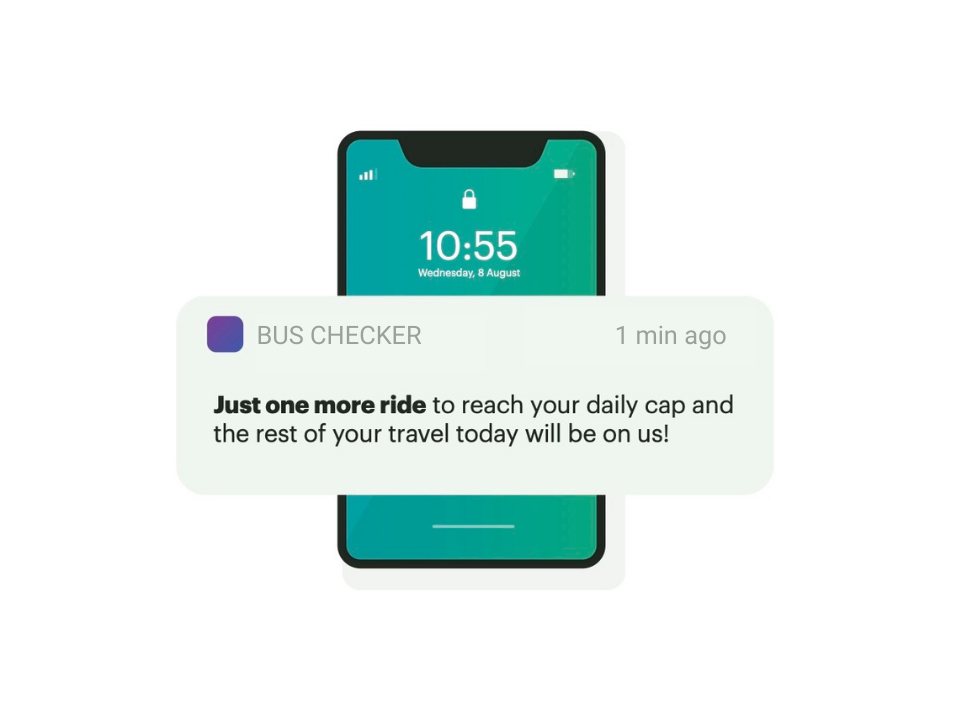

Additionally, they can monitor and understand their payments and travel history via a mobile app, regardless of whether they use contactless or mobile payments. By enabling push notifications, they can receive real-time updates that keep them in the loop about what they are spending on travel and when they hit a fare cap – after which travel is free.

We’re very excited about our partnership with Littlepay. We have the same shared goals to create a seamless, user-friendly travel experience. The Littlepay platform is a proven, reliable platform that is complementary to the UrbanThings MaaS platform.

Carl Partridge, CEO, UrbanThings

We are delighted to partner with UrbanThings to unify payments across the MaaS channels supported by their UrbanHub platform. It is exciting when we get to work with like-minded teams, equally committed to advancing innovation in the transport industry.

Sheryll Ricketts, Solutions Consultancy Lead, Littlepay

UrbanThings and Littlepay will jointly explore future solutions that harness the power of a state-of-the-art data platform and robust contactless payments to bring MaaS to life. If you would like to find out more about this, please contact our team.

Insight

Insight

Knowledge

Knowledge

News

News